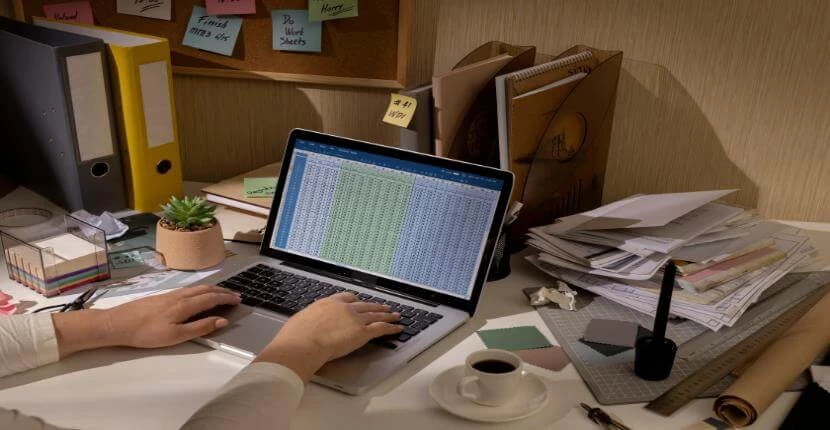

management accounts

Get in touchAt Professional Accountants, we understand how critical management accounts are for businesses and across the UK seeking to make confident, informed decisions.

While statutory accounts give an annual snapshot, management accounts offer a real-time view of business performance, helping directors and business owners stay in control of their finances month by month.

Whether you’re scaling a start-up, managing cash flow in a mature SME, or reporting to stakeholders, regular management accounts provide the clarity you need to steer your business forward with precision and agility.

What Do Management Accounts Services Cost in or Around ?

The cost of management accounts services ranges from £250 to over £750 per month, depending on business size, reporting frequency, and the depth of financial analysis required.

Costs are primarily influenced by the level of reporting detail, the inclusion of KPI dashboards or departmental analysis, integration with business intelligence tools, and whether bookkeeping or payroll services are bundled.

Contact Professional Accountants to get customised quotes for your business.

Why Are Monthly or Quarterly Management Accounts Important for Businesses?

Regular management accounts allow businesses to stay proactive rather than reactive. Instead of waiting until year-end to assess performance, you get monthly or quarterly insights into revenue, expenses, margins, and cash flow.

This allows for early detection of financial issues, timely adjustments to strategy, and ongoing tracking of progress toward business goals. For businesses facing economic uncertainty or operating in fast-changing industries, management accounts are essential for forecasting, budgeting, and maintaining financial control.

What’s Included in a Set of Management Accounts for -Based Businesses?

A comprehensive set of management accounts provides valuable insight into business performance and financial health, typically including:

Profit and loss statement – Summarises income and expenses to show profitability over a set period.

Balance sheet – Outlines assets, liabilities, and equity to reflect the business’s financial position.

Cash flow report – Tracks money movement to assess liquidity and operational efficiency.

Key performance indicators (KPIs) – Highlights critical metrics specific to business goals and sectors.

Budget comparisons and variance analysis – Evaluates performance against forecasts to identify trends or shortfalls.

Aged debtor and creditor listings – Details outstanding customer invoices and supplier balances for cash management.

Commentary and insights – Provides interpretation of financial data to support decision-making.

Departmental or segmental analysis – Breaks down performance by division, location, or product line for deeper insights.

Trend charts and rolling forecasts – Visualises growth patterns and predicts future financial outcomes.

Custom reporting options – Tailors the structure and content of reports to align with business objectives and stakeholder needs.

How Can Management Accounts Help Track Performance and Cash Flow?

Management accounts help businesses of all sizes to track whether they’re operating profitably, keeping expenses under control, and maintaining healthy cash flow. By comparing actual results to budgets and past performance, you can spot trends, detect inefficiencies, and make decisions backed by evidence rather than assumptions.

Cash flow forecasting, in particular, can help businesses plan for seasonal dips, invest with confidence, or prepare for funding rounds or expansion.

Do Management Accountants Offer Budget Forecasting and KPI Reporting?

Many management accountants offer comprehensive support beyond monthly accounts, including budget forecasting, scenario planning, and custom KPI tracking. A management accountant can help you define meaningful metrics and build financial models to monitor them.

This data-driven approach is especially valuable for owner-managed businesses, CFOs, or teams looking to report to boards, banks, or investors.

Is Outsourcing Management Accounts a Cost-Effective Move for SMEs?

For SMEs, outsourcing management accounts is often a highly cost-effective solution as it removes the need to hire full-time finance staff while still providing expert insight into business performance. An outsourced accountant can bring best practices, industry benchmarks, and a fresh perspective that may be lacking internally.

Additionally, they can scale their services as your business grows, offering simple reporting to start and increasing sophistication as needed. Outsourcing also allows you to access high-level financial analysis without paying the overheads of an in-house financial controller or finance director.

Can Management Accounts Support Better Decision-Making and Growth?

Management accounts for business owners and directors can use this data to make timely hiring decisions, adjust pricing strategies, review supplier costs, or negotiate contracts more confidently.

Over time, these incremental decisions drive improved profitability, lower risk, and more sustainable growth. For businesses seeking investment or preparing for sale, a solid history of management accounts can also boost credibility and streamline due diligence.

How Often Should Businesses Review Their Management Accounts?

Most SMEs benefit from monthly management accounts, which offer the best balance between visibility and cost. Fast-moving businesses or those in seasonal industries may require even more frequent updates, while more stable businesses may opt for quarterly reporting.

Regular reviews, whether monthly or quarterly, ensure your business remains financially agile and well-informed, allowing for faster reaction to external market changes or internal performance shifts.

Contact Professional Accountants for a consultation on getting management accounting services.

Get in touch

Skip to

Gallery